Abstract

In 2021, India committed to achieving Net Zero emissions by 2070. Indian Prime Minister announced this commitment at COP26. The Indian government is committed to focusing on transport, buildings, urban and power sectors to achieve Net Zero by lowering greenhouse gas emissions. India has already started investing in the “Ethanol Economy” by replacing a significant fraction of transport gasoline with Ethanol. India has progressively increased ethanol use by enhancing ethanol production capacity. National Institution for Transforming India (NITI Ayog), a think tank of the government of India, has envisioned “Methanol Economy” to support energy transition activities. Technology demonstrations for methanol production and vehicle field trials have been undertaken. This paper aims to summarise the role of the “Methanol Economy” and “Ethanol Economy” in India’s quest for energy transition to achieve Net-Zero. India’s energy security and the approaches followed by other countries to achieving net zero are summarised as well. Various aspects of the “Methanol and Ethanol Economy”, such as production capacity, emissions, and role for greenhouse gas emissions reductions, are discussed. Various steps taken by the government of India are summarised, which include setting up standards for the adaptation of methanol/ethanol, setting up production infrastructure, and technology development for end-user applications etc.

Keywords: Net Zero, Green House Gases, Methanol Economy, Ethanol Economy

Abbreviations:

ARAI Automotive Research Association of India

CO2 Carbon Dioxide

DHI Department of Heavy Industry

DME Dimethyl Ether

DMFC Direct Methanol Fuel Cell

EFB Empty Fruit Bunches

ERL Engine Research Laboratory

GHG Greenhouse Gases

GoI Government of India

IIP Indian Institute of Petroleum

IITK Indian Institute of Technology Kanpur

IOCL Indian Oil Corporation Limited

IPCC International Panel for Climate Change

LPG Liquified Petroleum Gas

MoPNG Ministry of Petroleum and Natural Gas

MoRTH Ministry of Road Transport and Highways

MSW Municipal Solid Waste

NDC Nationally Determined Contribution

NITI Ayog National Institution for Transforming India Aayog

SIAM Society of Indian Automobile Manufacturers

1. Introduction

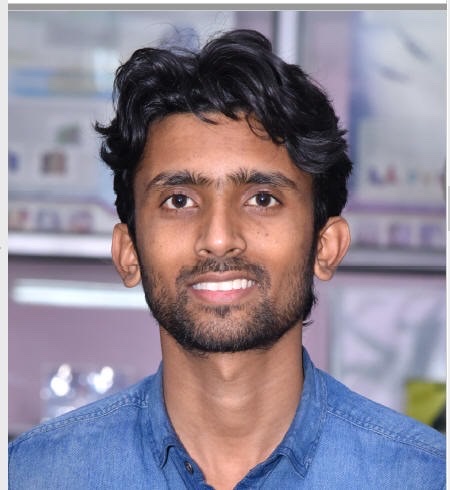

The climate is rapidly changing, and its global impact raises a question mark on the existence of humanity. All-encompassing proactive actions are needed to overcome the alarming situation by reducing greenhouse gas (GHG) emissions emitted by all anthropogenic activities. Researchers and policymakers continuously monitor the climate and decide on action plans globally. In 2015, a global treaty called the “Paris Agreement” was signed by 196 countries, which agreed to reduce GHG emissions [1]. Paris Agreement was aimed at achieving sustainable development by stopping the average global temperature rise > 2˚C (ideally 1.5 ˚C) by 2030 [2]. In 2018, International Panel for Climate Change (IPCC) stated that the global climate is changing intensely and worsening faster than anticipated [3]. They recommended reducing GHG emissions to net zero to keep the average global temperature rise limited to 1.5 ˚C. They also suggested replacing ~70–85% of fossil fuel usage with renewable energy worldwide. This demands extensive use of low-carbon energy and technologies instead of fossil fuels to meet the global energy demand. In this regard, developed countries must decide their role in achieving Net Zero and simultaneously support developing countries to achieve it. India is the world’s third largest global carbon dioxide (CO2) emitter, despite low per capita CO2 emissions [4]. India’s carbon intensity from the power sector is above the global average, which can be understood from the emissions from individual sectors, as shown in Fig. 1 [4]. In addition, particulate emissions are a serious issue in India, becoming quite alarming in 2019.

Figure 1 CO2 emissions from various sectors of the Indian economy [4]

India aimed towards a secure and sustainable future. India’s first pledge had three primary goals for achieving sustainability, known as ‘Nationally Determined Contributions’ (NDC). These goals are: (i) to reduce emissions by ~33-35 % below 2005 levels; (ii) to install at least 40% of electric power based on non-fossil energy by 2030; and (iii) to create a carbon sink of 2.5-3 billion tonnes of carbon dioxide equivalent by 2030 [5]. In addition, India announced five new points, as communicated by the Indian Prime Minister at the COP26 meeting in Glasgow. These sets points are: (i) India will increase the non-fossil energy capacity to 500 GW by 2030; (ii) India will cater to ~50% of India’s energy demand using renewable resources by 2030; (iii) India will reduce the carbon footprint by 1 billion tonnes by 2030; (iv) India will bring down the carbon intensity > 45% of the economy; and (v) India will achieve the net zero target by 2070 [6]. India must take mammoth steps towards energy transition to achieve these ambitious targets. For this, it becomes necessary to understand the current energy requirement in various sectors. Also, the strategies of various countries need to be understood to combat climate change. This section is divided into two sub-sections: (i) Energy security; and (iii) Global preference for the energy transition.

1.1 Energy Security

Energy security is defined as (i) availability of energy, which means people must get energy to fulfil their demand for improving their lifestyle; (ii) accessibility of energy, which means it should be easily accessible to the people of urban as well as non-urban area; and (iii) affordability of energy, which means it should be available at lower prices. India plays a significant role in the global energy economy, and its consumption doubled in 2000.

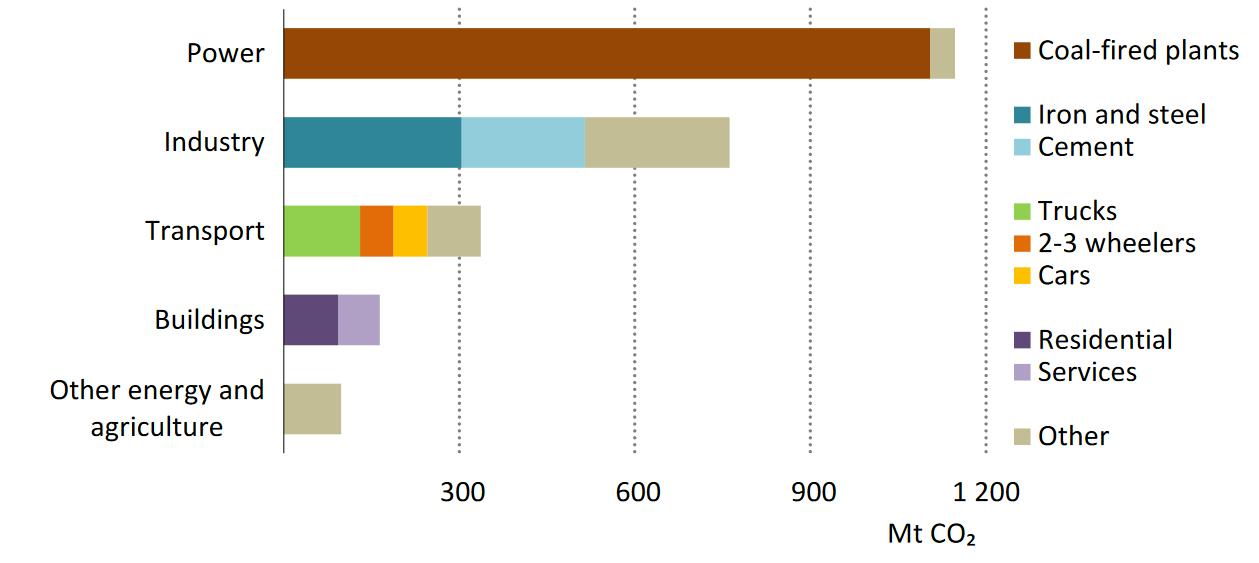

Figure 2 Population, GDP, and Energy Demand of India in 2000, 2010 and 2019 [4]

The upward trend in energy consumption is due to rapidly increasing population, urbanisation, industrialisation, and economic growth, as seen in Fig. 2 [4]. The primary energy sources for India are coal, oil, and natural gas. Globally, India is 2nd largest coal market. Hence coal plays a dominant role in fulfilling India’s energy demands. Most of the coal is utilised for power generation, steel and iron industries. Coal demand has nearly tripled since 2000, fulfilling ~44% of total national energy demand, the third highest among G20 countries [4]. However, Indian mines cannot produce coal at the same pace as the increase in coal demand. Hence there is a steady rise in imported coal as well. In addition, electricity consumption has tripled in the last two decades due to ramping up of household appliances due to urbanisation and rising income levels. In 2019, coal played a predominant role by contributing almost 70% of the total power generation.

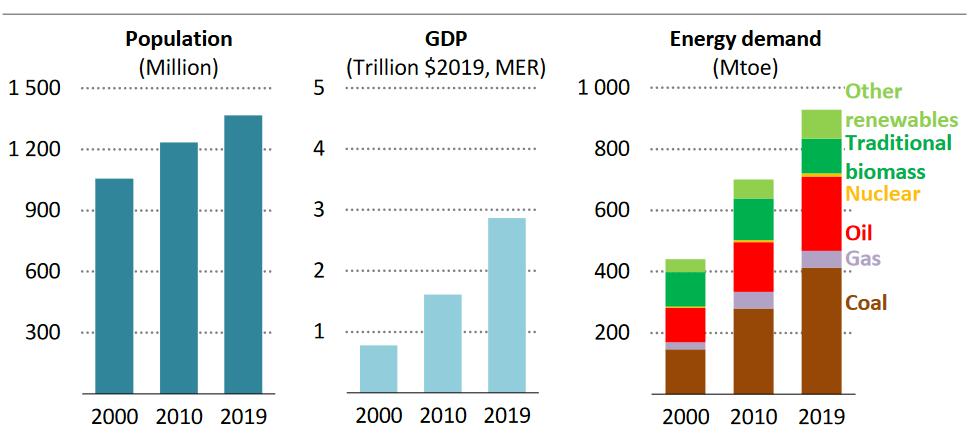

Similarly, domestic oil resources are not enough to meet the domestic demand. That’s why India is in 2nd position globally in importing oil, after China. The share of natural gas has remained almost flat, at ~6% in India’s energy mix [4]. The energy demand is shifting continuously among various sectors of the Indian economy. Biomass showed a declining trend in the energy mix since its usage is reduced due to the increasing use of household liquified petroleum gas (LPG). The rise of solar photovoltaic (PV) modules also played a spectacular role in supporting the energy demand in power generation at the lowest price. The importance of coal, oil and gas can be understood from Fig. 3 [4], which shows details of their production, imports and import dependence.

Figure 3 Production and Imports of Coal, Oil and Gas in India over the years [4]

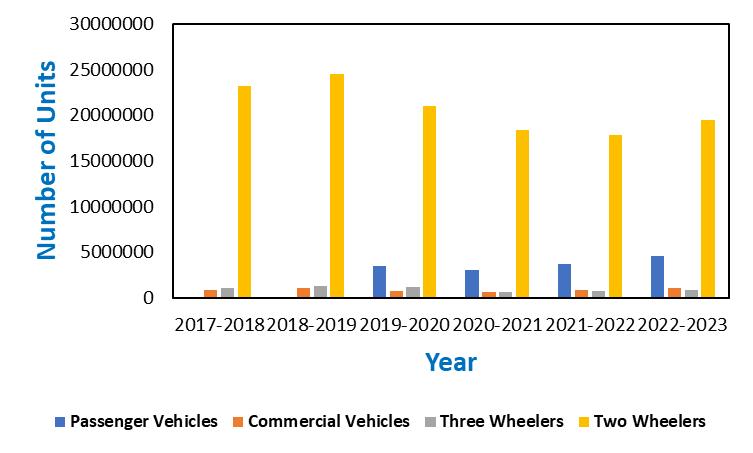

Indigenous resources are grossly insufficient to fulfil India’s galloping energy demand. Hence imports have become essential. Oil consumption and imports have increased rapidly due to increased vehicle ownership and road transport demand. Indians travel almost thrice on average since 2000, which is approximately 5000 km per year. The Indian two-wheeler (2W) fleet has increased exponentially over the years, and now India has one of the largest 2W markets. Rapid growth in four segments of the road transport sector, namely (i) Passenger Vehicles, (ii) Commercial Vehicles, (iii) Two-Wheelers, and (iv) Three Wheelers, is seen in Fig. 4.

Figure 4 Rapid Growth in Vehicle Sales in the Indian Transport Sector

This rapid growth was supported by a sharply expanding road network in the last few years. According to the Ministry of Road Transport and Highways (MoRTH) report, the road network was 3.3 million km in 2000, which expanded to 5.9 million km in 2016 [4].

1.2 Global preference for the energy transition

China and Brazil have gained significant national experience in lowering their GHG emissions by implementing the “Methanol Economy” and “Ethanol Economy”. Their implementation strategies and transitions are summarised below.

China:

China first focused on the ethanol economy, introducing ethanol-gasoline blends (E10) in the transport sector. The economic benefit is the main driving force for catapulting the economic growth of any country. China realised that methanol is much cheaper than ethanol and could become a game-changer for its economic growth. Thus purely on economic merit, the methanol industry development started spontaneously in China. The Chinese government realised that increasing growth of the automotive sector either increases fuel imports significantly or threatens the existing oil reserves to exhaustion. Higher economic growth requires more energy. China had very little domestic natural gas and oil resources, but it is a coal-rich country with vast resources. Therefore, China started transitioning from ethanol to a methanol economy by switching transport in six provinces to coal-based methanol. These were Ningxia, Shanxi, Inner Mongolia, Sichuan, Shaanxi, and Gansu. Chinese government promulgated a report entitled “Development report of China’s alcohol and ether fuels and the clean automotive fueled with them”, which accelerated the penetration of the methanol industry in China. The industry started selling M15 at more than 1000 fuel stations in ten provinces [7]. China made dedicated organisations focusing on constructing, transporting, storing, and managing methanol-based gas stations. The Chinese government also provided subsidies for converting existing engines to methanol. It supported several pilot projects at the provincial level.

India also has abundant coal reserves, which can be used for methanol production. Therefore, the methanol economy can play a vital role in India achieving Net Zero by 2070.

Brazil:

Brazil realised early on that biofuels would play a vital role in climate issues and economic growth. Biofuels have been vital to Brazil’s national policy for nearly half a century. Brazilian government launched a Pro-alcohol programme to combat the first oil shocks in 1975 [8]. After that, they developed an ethanol-based economy in Brazil. In 2019, the Brazilian government started the “RenovaBio” programme to achieve an output of 50 billion litres of ethanol production and 45% ethanol-gasoline blends, which currently stands at 27%. Ethanol production in Brazil has grown 45 times, and the price is lower by 70% w.r.t. the base year of 1975 [8]. Brazil also aims to use ethanol as an aviation fuel. Brazil’s ethanol economy saved its foreign exchange of $261 billion and avoided 1.34 billion tons contribution to CO2. Brazil also uses ethanol in the gas, power, and agriculture sectors [8]. In 2020, sugarcane-based bioelectricity was supplied in Brazil, representing almost 5% of national electricity consumption.

The agriculture sector is the backbone of India’s economy, just like Brazil, and both countries are the largest sugarcane producers. Therefore, the ethanol economy, like Brazil, can benefit India and support its commitment to Net Zero.

2. Drivers of India’s Energy Transition

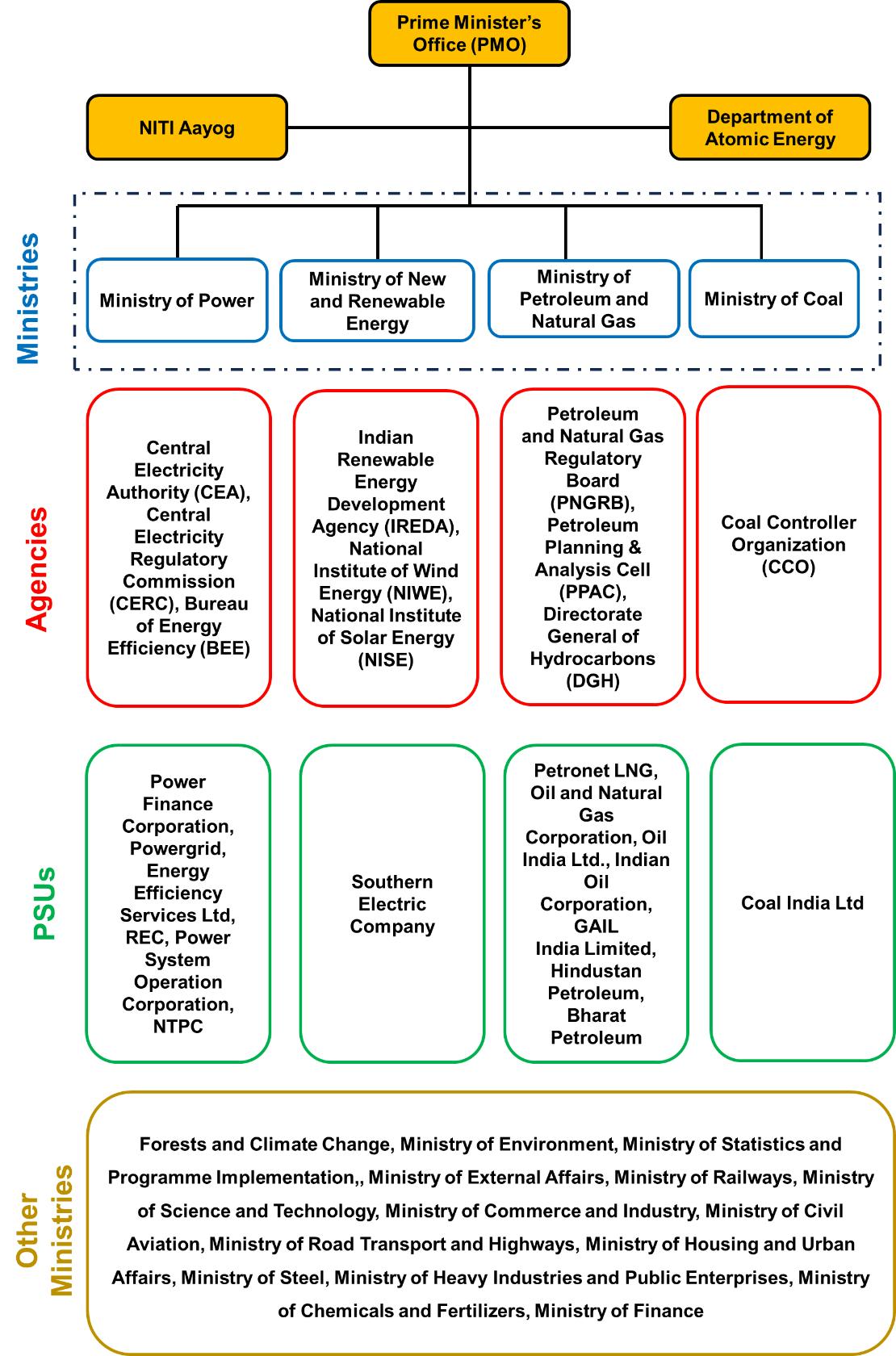

India’s energy ambitions are sector-specific and often desperate because different ministries and agencies nationwide control the growth of this sector (Fig. 5).

Figure 5 Different ministries, agencies, PSUs, and other ministries across the Government of India (GoI) controlling the energy landscape

The mission objective of the structure of GoI is to provide reliable, sustainable, and affordable energy for the nation’s citizens and services. India is undergoing a significant transformation as it moves towards a low-carbon economy. The nation’s existing energy policy and that in the works highlights and shows India’s transition to cleaner fuels sustainably. To strengthen national energy security, India has supported the development of alternative fuels such as methanol, ethanol, dimethyl ether (DME), and hydrogen. Intending to decarbonise the transport sector, GoI is working on two parallel verticals: (i) the Ethanol economy and (ii) the Methanol economy, which are discussed below.

2.1 Ethanol Economy

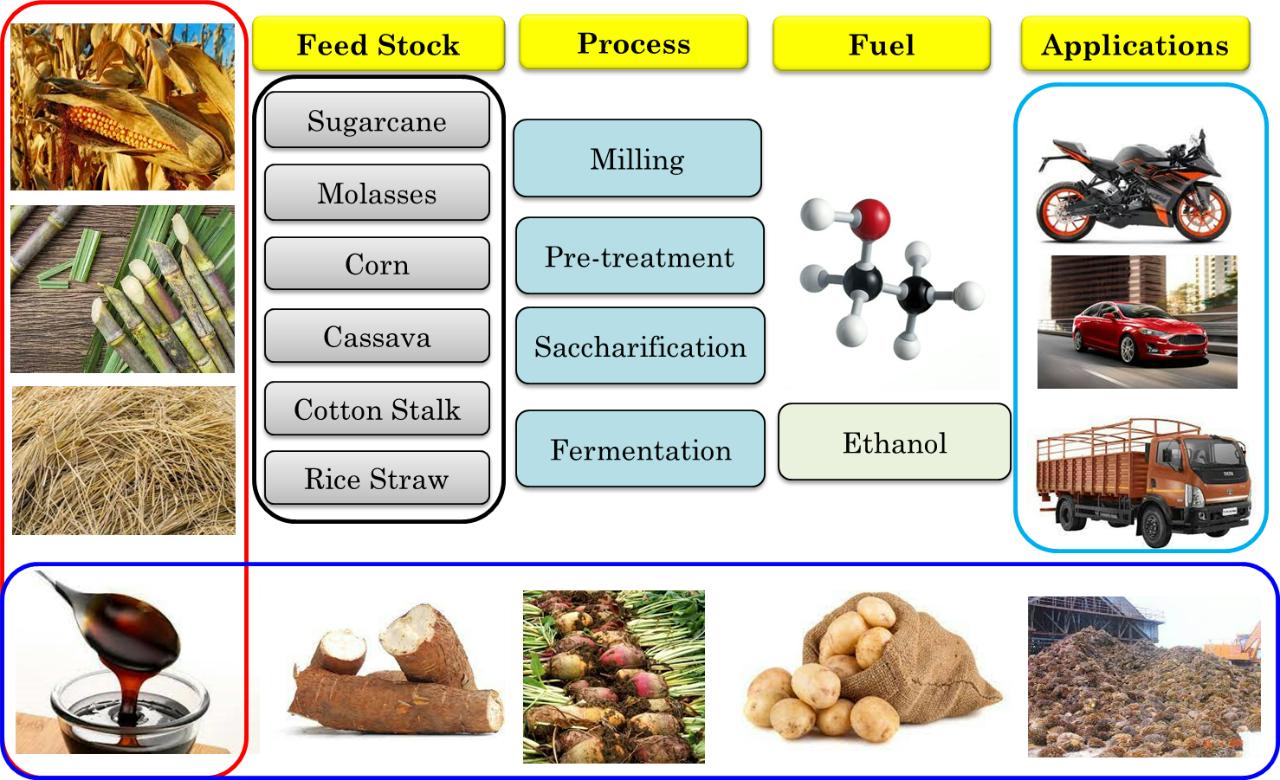

The agricultural sector plays a vital role in India’s economy. Ethanol can be produced from agricultural feedstocks, which would help achieve the ambitious target of Net Zero by 2070. In India, ethanol is categorised based on feedstocks used for its production, namely: (i) 1G ethanol, produced using sugarcane juice, corn, cassava, potatoes, sugar beet and molasses; (ii) 2G ethanol, produced using straw, empty fruit bunches (EFB), cane trash, cotton stalk, bagasse, and corn cobs; and (iii) 3G ethanol, produced using Microalgae. Ethanol can be used as an energy source in various sectors of the Indian economy, as shown in Fig. 6.

Figure 6 Ethanol Economy for India

India started investing in economic development based on ethanol in the last decade. After successfully demonstrating several pilot projects, India started using ethanol as an automotive fuel in the transport sector. First, Ethanol was blended with gasoline (1.6 %) in 2013-2014. Over the years, India continued the ethanol blended program, and Indian oil marketing companies recently achieved an average 11.75 % ethanol blending level pan India [9]. Generally, ethanol is produced using C-heavy molasses as a primary feedstock. GoI realised it was not benefiting India’s economy due to higher feedstock prices. Thus, India started using B-heavy molasses, sugarcane juice, and surplus rice as feedstocks for ethanol production. However, ethanol prices are still quite high at 45.69 Rs/l for ‘C’ heavy molasses-based Ethanol, 57.61 Rs/l for ‘B’ heavy molasses, 62.65 Rs/l for direct cane juice, 51.55 Rs/l for damaged food grains/maise, and 56.87 Rs/l for surplus rice of the Food Corporation of India (FCI) [10]. Recently, GoI announced an ambitious target of achieving 20% ethanol blending in gasoline by 2025 to save Rs 30,000 crores (Approximately US $ 4 Billion) in foreign exchange while enhancing national energy security, lowering carbonaceous emissions and improving the ambient air quality. Proposed milestone actions for achieving E20 pan India are mentioned below [11]:

* Raise annual ethanol production capacity from 700 to 1500 crore litres.

* Phased rollout of E20 by April 2023 and ensuring nationwide coverage by 2025.

* Roll out of E20-compliant and E10 engine-tuned vehicles by 2023.

* Produce E20-tuned cars from 2025 onwards.

* Promote technology development for ethanol production from non-edible feedstock.

However, the ethanol blending program faces several challenges, such as (i) grain conversion to ethanol is not allowed, (ii) ethanol is facing high taxation issues, (iii) there are hurdles in procuring ethanol due to multiple tendering processes and limited infrastructure, (iv) un-availability of raw materials, (v) high prices, and (vi) constraints from the state governments [12]. To address some of these issues, GoI introduced a bio-refinery-based model by promoting (i) 2G Ethanol plants, (ii) Grain based 1G Ethanol plants, (iii) CBG plants, (iv) Chemical production, and (v) Cogeneration Plants [12].

To support the ethanol economy vision, the government is continuously working on four pillars: (i) Setting standards for the adaptation of ethanol, (ii) Setting up infrastructure, (iii) Technology development, and (iv) End-user applications. These pillars are discussed comprehensively in the following sub-sections.

A. Setting standards for ethanol adaptation: Different technical specifications are notified by the Bureau of Indian Standards (BIS). Some of them are mentioned in the table below.

Table 1 Setting Standards for ethanol

| Sr. No | Fuel | BIS Number |

| 1 | E0/E5/E10 | IS: 2796: 2017 |

| 2 | E20 | IS: 17021: 2018 |

| 3 | E85 | IS: 16634:2017 |

| 4 | E100 | IS: 15464: 2004 |

B. Setting up infrastructure: A material compatibility study for existing engines/ vehicles using E20 as fuel is undertaken jointly by OEMs, OMCs, and Test Agencies. The Society of Indian Automobile Manufacturers (SIAM) has assured that once the Ministry of Petroleum and Natural Gas (MoPNG) issues the roadmap for the availability of ethanol-blended fuels in the country, OEMs will gear up to supply compatible vehicles in line with the roadmap.

C. Technology development: Department of Heavy Industry (DHI) funded a project for evaluating a 20% ethanol-gasoline blend (E20) to the Automotive Research Association of India (ARAI), Indian Institute of Petroleum (IIP) and Indian Oil Corporation (R&D) in 2014-15. Suitable technologies are being developed in this project for Indian vehicles.

D. End-user application: Nationwide, E20-compliant, and E10 engine-tuned vehicles should be rolled out from April 2023. Nationwide, E20-compatible 4W vehicles will be rolled out by April 2025.

2.2 Methanol Economy

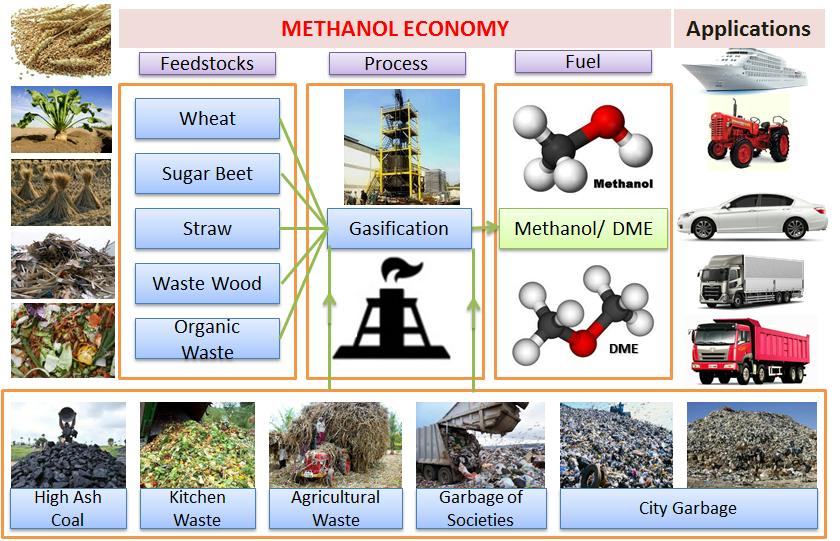

Achieving Net Zero emissions by 2070 is a significant challenge for India, requiring urgent action nationwide. Methanol can be essential in decarbonising various sectors of India’s economy to achieve the ambitious Net Zero target. National Institution for Transforming India (NITI Ayog) leads the methanol economy under Dr Vijay Kumar Saraswat, Member (Science and Technology). The methanol economy aims to reduce India’s oil import bill and GHG emissions simultaneously. The methanol economy is a significant step towards a low carbon/ carbon neutral economy. Methanol can be used as an energy source for thermal power generation, road transport, power generation, marine transport, boilers, gen-sets, and fuel cells and as a feedstock for producing commodity chemicals (Fig. 7) [13].

Figure 7 Methanol economy landscape for India

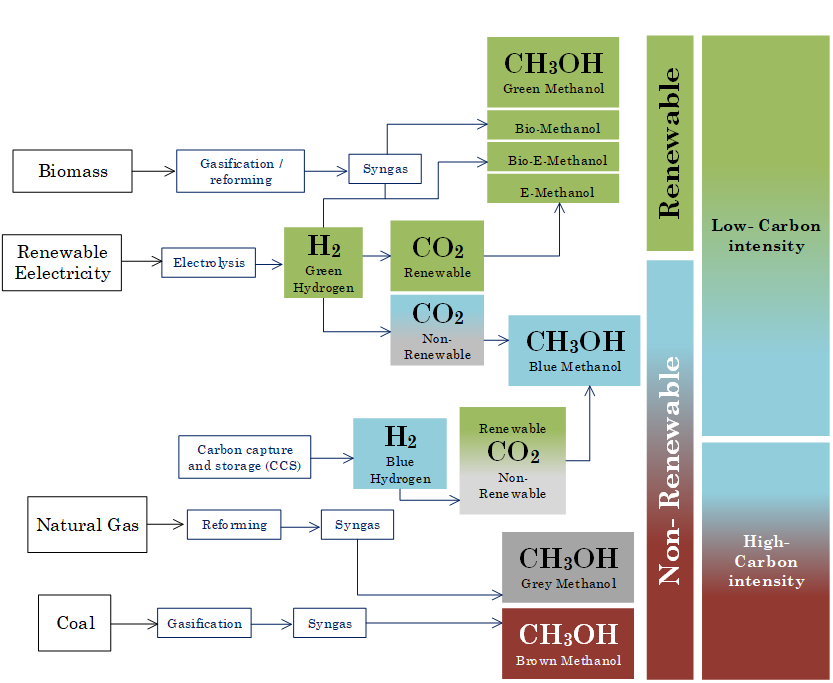

Methanol is a single-carbon fuel. It can be produced from renewable and non-renewable resources such as high-ash coal, natural gas, low-value biomass, atmospheric CO2, and municipal solid waste (MSW). Methanol can be termed brown, green, or grey, depending on the path followed to produce it, as seen in Fig. 8.

Figure 8 Methanol production routes for various feedstocks. (Adopted From Renewable Methanol report by IRENA and MI)

Valera et al. [14] advocated the methanol economy for India’s transition from a developing country to a developed country bases on triple P (3P) factors: (i) Production: Methanol can be produced using indigenous resources, reducing its dependency on other countries; (ii) Pollution: Methanol upon combustion produces lower carbonaceous and hydrocarbon emissions thereby, support Net Zero mission; and (iii) Price: Methanol is cheaper than conventional diesel-gasoline like fuels. Methanol production is dominated by non-renewable feedstock resources in India, e.g., Natural Gas. However, its production via renewable resources is gaining traction to avoid fossil fuel use. Methanol production through MSW would create a circular economy, enhancing waste-to-wealth conversion. Methanol also has the potential to support the “Hydrogen Economy” because it is an efficient hydrogen carrier in liquid form and acts as a bridge for a successful transition to the hydrogen economy. Methanol can produce dimethyl ether (DME) as a feedstock. The methanol economy vision will also help improve the ambient air quality in Indian Cities because methanol has significantly cleaner combustion properties. Different ministries of GoI are also showing interest and support for implementing Methanol Economy. MoRTH Minister Shri. Nitin Gadkari has been continuously stressing using methanol as an alternative fuel in the transport sector [13]. According to the road map, the methanol economy could create 5 million jobs in distribution services, applications, and production. Rs 6000 crores per year could be saved by producing DME from methanol and blending it with LPG (50% w/w). “India’s Leapfrog to Methanol Economy” report estimated that methanol can be made available at 17-19 Rs./l, if 1600 tonnes per day capacity plants can be introduced in India [15]. Currently, the methanol production cost is 25-27 Rs/l, subject to volatility in natural gas prices. GoI sees the methanol economy vision from four perspectives: (i) Technical: What are the technical challenges, and how can India overcome them? (ii) Economic: How the methanol economy will impact the economy and individual’s pocket? (iii) Consumer: What does it mean to the energy end users? And, how to convenience users? and (iv) Delivery: What is the roadmap from today’s position to the targeted vision?

To address these issues, a task force has worked on four steps: (i) Setting standards for the adaptation of methanol; (ii) Setting up infrastructure; (iii) Technology development; and (iv) End-user application. These pillars are discussed comprehensively in the following subsections:

Setting standards for methanol adaptation: BIS notified fuel standards/ specifications for M15, M85, M100 and 20% DME blended with LPG. The MoRTH issued these standards.

Setting up infrastructure: Six methanol plants (5 high-ash coal based and one natural gas based) will be set up with technical assistance from Israel. Thermax Ltd, Pune, has developed a 5-kW methanol-based reformer for the Direct Methanol Fuel Cell (DMFC).

Technology Development: SIAM, IOCL, and ARAI undertook joint fleet testing of vehicles (2W and 4W) on M15 blends, successfully concluded in 2022. Engine Research Laboratory (ERL), Indian Institute of Technology Kanpur (IITK) undertook a project of 1D and 3D modelling of locomotive engines for finalising the best technical route for methanol adoption in this application. ERL, IIT Kanpur undertook several vehicle prototype development for M15, M85 and M100 applications in 2W and 4W engines of different capacities using different fuel induction technology. ERL, IIT Kanpur also developed several genset prototypes for M15 and M85 SI engines gensets. In addition, they displaced 87% diesel energy by methanol in a 15 kW diesel genset. A 140 kVA genset engine using a large diesel displacement by methanol is under development. Different fuel induction technologies are used in these gensets.

End-User Application: Methanol-fuelled Cargo vessels (7 Nos) and boats (3 NoS) are under preparation by Cochin Shipyard Limited. Kirloskar Oil Engines Ltd, Pune, has converted a 5-kW generator to operate on 100% methanol. Also, a 150-300 kVA/kW generator is being developed in collaboration with Dor Chemicals, Israel. Thermax, IIT Delhi, and BHEL Hyderabad & Trichy are working to demonstrate a 1 TPD and a 40 TPD demonstration plant for coal-to-methanol conversion, respectively. GoI has announced the standards for separate ethanol-gasoline blends and methanol-gasoline blends for decarbonising the transport sector. A gasoline energy equivalent blend can be produced for India’s transport sector, a mixture of 20% (v/v) ethanol and 15% (v/v) methanol (E20 + M15) [16].

3. Recommendations

The GoI should take urgent steps to promote the ethanol and methanol economy initiatives to achieve the Net Zero emission target by 2070. These steps would help various stakeholders understand the role of “Ethanol” and “Methanol” in the context of Net Zero commitments of the nation. These steps must be pointed out in an international context, and approaches of other countries must be absorbed to learn important lessons from them. While preparing the roadmap, due considerations should be given to price, national energy security, and economic resilience. GoI should consider the co-existence of the ethanol and methanol economy in parallel since ethanol and methanol ate the future alternate and complementary pathways for achieving Net Zero. Initially, the methanol market could be based on ‘brown methanol’. However, the producers should start transitioning towards ‘green methanol’ as early as demand stabilises. Technology transfer should be promoted from foreign countries, and indigenous technologies must be simultaneously developed.

Similarly, ethanol producers should transition towards 2G and 3G ethanol. Plant development/ capital costs may seem high but can be recovered over time. Renewable energy-based methanol/ethanol must be deployed in various segments of industries. Although India is in the nascent stage of methanol usage, it has gained almost a decade of experience in ethanol handling and usage. GoI should not overly stress green energy-based ethanol/methanol production at this stage. Transition to green would happen once the ethanol/methanol is deployed in the market. Collaboration must be promoted among Indian and international researchers to develop newer technologies for carbon capture, utilisation, and storage (CCUS). Research funding must be available to researchers to develop technologies for various application sectors. GoI should prepare a ten-year plan for mid-course corrections in the approach and strategy to implement Ethanol and Methanol Economies to achieve Net Zero by 2070.

4. References

[1] The Paris Agreement | UNFCCC unfccc.int (accessed August 14, 2023).

[2] Key aspects of the Paris Agreement | UNFCCC unfccc.int (accessed August 14, 2023).

[3] IPCC - Intergovernmental Panel on Climate Change ipcc.ch (accessed August 14, 2023).

[4] India Energy Outlook 2021. India Energy Outlook 2021 2021. doi.org.

[5] Approval translates Prime Minister ‘Panchamrit’ announced at COP 26 into enhanced climate targets pib.gov (accessed August 14, 2023).

[7] Chen H, Yang L, Zhang PH, Harrison A. The controversial fuel methanol strategy in China and its evaluation. Energy Strategy Reviews 2014;4:28–33. doi.org.

[8] Brazil’s Ethanol Journey: From ‘a fuel of the future’ to the ‘future of fuel’, ET EnergyWorld. indiatimes.com (accessed August 14, 2023).

[9] India’s ethanol push - Insights. insightsonindia.com (accessed August 14, 2023).

[10] Bansal R. Methanol: A Competitive Alternate Fuel NITI Aayog Government of India 2021. niti.gov.in (accessed August 14, 2023).

[11] Aayog N. Ethanol Blending In India 2020-25 Roadmap For Report of the Expert Committee 2021. niti.gov.in (accessed August 14, 2023).

[12] Aatmanirbhar F, Dream B. Ethanol Growth Story. mopng.gov.in (accessed August 14, 2023).

[13] India Methanol Economy Coalition IMEC. methanol.org (accessed August 14, 2023).

[14] Valera H, Singh AP, Agarwal AK. Prospects of Methanol-Fuelled Carburetted Two Wheelers in Developing Countries. Energy, Environment, and Sustainability 2020:53–73. doi.org. (accessed August 14, 2023).

[15] Bansal R. Saraswat, V.K. and Bansal, R., 2017. India’s leapfrog to methanol economy. Niti Ayog.

[16] VK Saraswat. Co-existence of Methanol and Ethanol Blends as Alternative Fuels.

___________________________

___________________________

Disclaimer: Views expressed here are personal.